On this page

Overview

The Australian Pesticides and Veterinary Medicines Authority (APVMA) and all other cost-recovered government agencies regularly review our fees and levies to ensure that the amount we charge is commensurate with our operational costs. As a result of standard cost forecasting, we have identified that without changes to our current pricing structure, the APVMA will run a deficit in the 2024–25 financial year.

If the revenue we receive from fees and levies does not meet our operational expenses this will negatively impact service quality. Decreased service quality will mean delayed permit approvals for industry, delayed reviews of health and environmental impacts, and poorer outcomes for the Australian community. We see this outcome as unacceptable.

A consultation process will be run from July to September 2024, we are seeking submissions from all stakeholder groups, including regulated industries and the wider Australian community, so that we can ensure our pricing structure does not impose undue burden and supports future market developments.

The last broad base increase in fees was 2020 and was part of a broader financial sustainability plan for the APVMA. A review of pricing in 2022 resulted in the creation of 4 new modules and consolidating several health modules.

Our approach to engagement

The APVMA is committed to transparent, meaningful engagement with stakeholders, including regulated industries and members of the Australian public.

We are considering a range of different options which represent different degrees of change to our current pricing structure. This year, we will explain several possible pricing structures to interested parties. There will be a number of formal and informal ways for you to provide feedback about these scenarios.

We strongly encourage interested parties to make their voices heard through this process. We would like submissions to represent a wide range of perspectives and interests to ensure our final proposed cost recovery structure meets community and industry expectations.

We are committed to providing as much information as early as possible.

What's in and out of scope

This consultation process is specifically focused reviewing the rate and proportionality of our fees and levies. As such, we will not extend the scope of this consultation process to include any other topics.

In scope

- The specific costs and fees applied regulated activities. These will be discussed in order to determine appropriate cost recovery fees.

- The rates and proportions applied to fee and levy tiers. This includes the current 60/40 split of fees vs levies.

- The collection of the annual fee for registered products.

- Timing and frequency of declaration and collection of levies.

Out of scope

- The APVMA will not review the amount of funding we receive from the Federal Budget. We are an almost fully cost-recovered agency and any changes to Federal Budget are a matter for government.

- The APVMA will not engage in detailed comparisons against our international regulatory counterparts. Direct comparisons between federal chemical regulators are unhelpful due to differences in our national legislation, government policies, and domestic markets.

What we need from you

The APVMA wants to understand the impacts that changes to fees and levies could have on different sectors and products. We are particularly interested in submissions that identify any impacts on industry or the Australian public that we have not already assessed.

We strongly encourage interested parties to make a submission once the formal consultation period has commenced, all submissions will be equally weighted and considered based upon their merits.

Our current fee structures

The APVMA is a fully cost-recovered agency, we derive our revenue from fees and levies which paid by regulated industries.

Application fees are divided into a number of categories. Each category is calculated based on the amount of APVMA resources required to assess an application in a timely and accurate manner. Levies are paid to the APVMA annually by our regulated industries based on the dollar value of regulated products sold on the Australian market.

Fees

The application fee and the timeframe for applications varies depending on their complexity. Information regarding APVMA assessment timeframes and fees is available on our website.

Levies

The Agricultural and Veterinary Chemical Products (Collection of Levy) Act 1994 (Collection Act) contains provisions for the collection of levies on agricultural and veterinary chemical products.

A person who holds an Australian Pesticides and Veterinary Medicines Authority (APVMA) registration for a chemical product, or a permit in relation to an unregistered chemical product (the holder), is liable to pay a levy based on the dollar value of domestic disposals (sales or uses by the manufacturer or importer) of the relevant chemical product.

Information about industry levies is available on the APVMA website.

Federal funding

We receive approximately 5% of our funding from the Department of Agriculture, Fisheries and Forestry (DAFF).

Currently this funding is directed towards corporate activities such as our cyber capability upgrades. Public good activities the APVMA must undertake, such as compliance enforcement and emergency permits, are not included in these corporate activities.

The amount of money provided to the APVMA for corporate activities is a matter for government, and we cannot base our models on the possibility of more money being allocated by DAFF.

Detailed information regarding APVMA finances is available as part of the Agricultural portfolio budget statements.

Projections

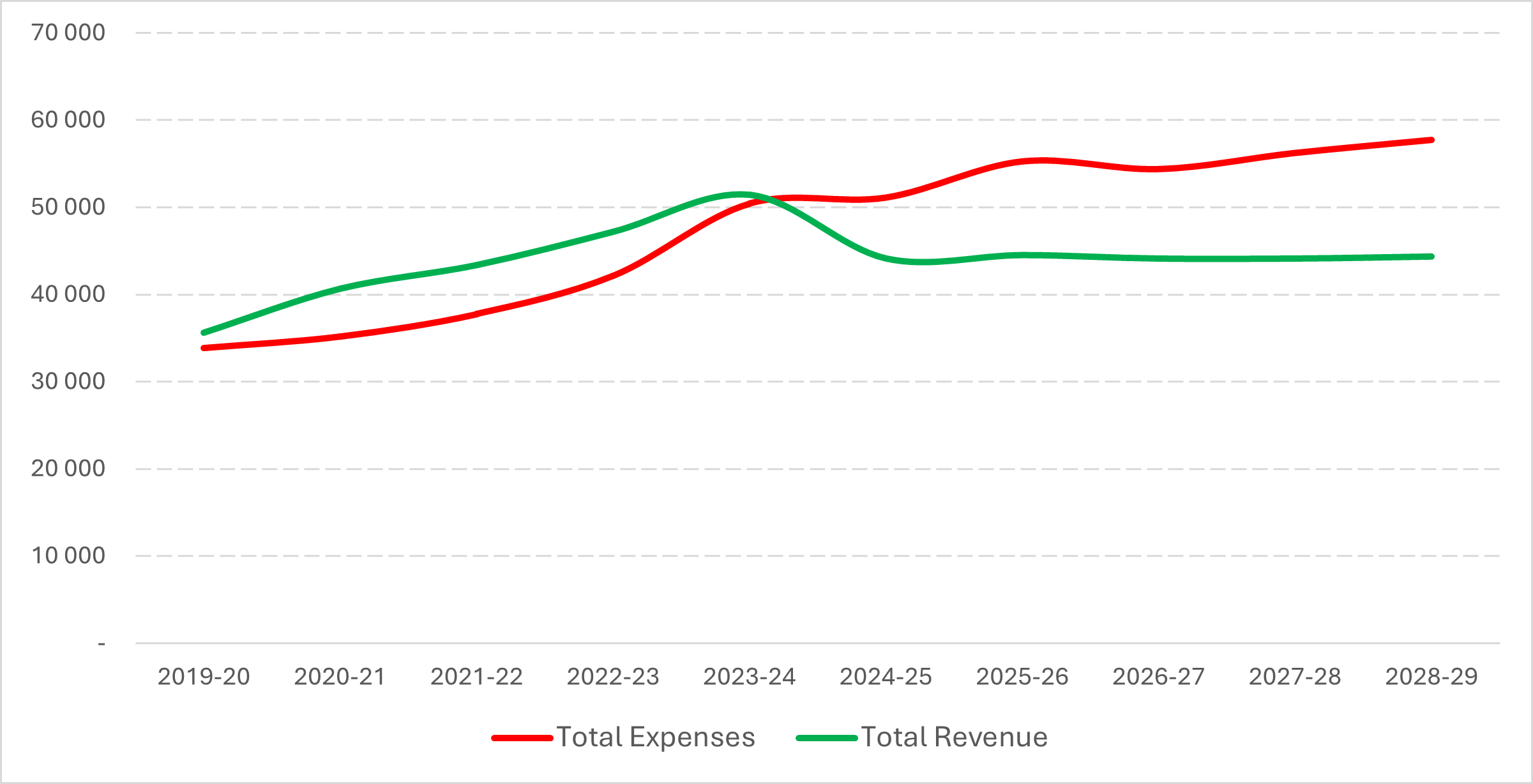

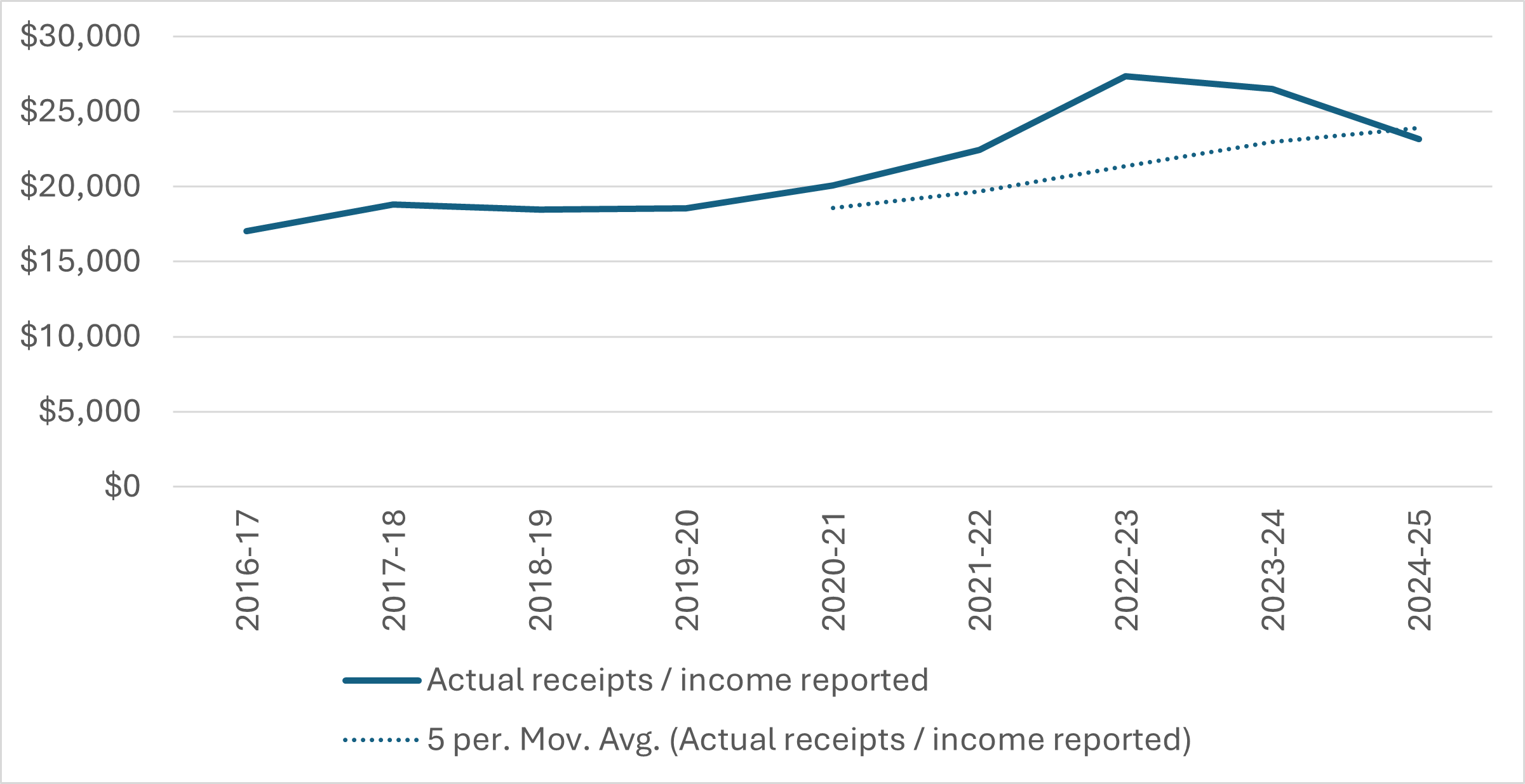

Since 2021 revenue from new registrations has decreased by 18%. The cost of providing registration services grew by 12% in 2022 and 2023, which is in line with the CPI.

Levy income exceeded our expectations in the years preceding 2021 due to a period of strong company sales. This has:

- restored financial sustainability 2 years earlier than originally forecast

- offset some of the increases in APVMA costs associated with nonregistration.

We project a series of operating deficits for FY 2024–25 through to FY 2027–28. The deficits are the result of inflationary pressures and flat revenue forecasts. This would be our first operating deficit since 2018–19.

The main factors contributing to the FY 2024–25 operating deficit for 2024–25 are:

- levy income, which is expected to reduce by $3.355m or 12%

- employee costs, which will increase by $1.197m as a result of the new Enterprise Agreement

- ICT costs, we expect it will cost $1.77 million dollars to improve network cyber security capability

- increases to supplier costs

- increased demand on post market regulatory activities.

Annual change in levy income

APVMA income vs expenditure